I’ve read a lot of articles on the subject of identity theft over the years. Most of the time they focus on how identity theft can happen. Things like stealing your mail from the trash, or misplacing your wallet in a public place. I’m not promoting forgetting about these easily solvable issues, but let me tell you why this is wrong.

First of all, this is not the movies. Identity thieves are not selecting a “mark” and following them around for days learning their habits so they can find a way to steal from them. That is a lot of work, and why would they go through all that effort when the simple truth is, they don’t have too?

So what are they doing? They’re going online and buying your information from a website. Now, don’t think that you’re so special that they targeted you specifically, because that is not how it works. They just buy a list of credit cards and go down the list until they find one that works and start charging it.

It doesn’t have to be credit cards, it could be your social security number, bank account information, or any other information that might lead to identity theft. But how are identity thieves getting this information in the first place? Let’s briefly review how businesses are consistently falling short of consumer expectations to secure data.

Companies are not doing enough

If you follow any sort of news whether it be TV, online, newspaper, etc. chances are you have heard of numerous security breaches. The simple truth is, most organizations are bad at Cybersecurity. It’s not entirely their fault, the bad guys are constantly looking for the slightest hole to exploit. A simple mistake of an employee clicking a link in an email is enough to lead to an event where all of your data is lost.

Take the Equifax breach from 2017 as an example. If you’re a US citizen with a social security number, there’s a good chance you heard about it. That’s because this breach led to 143 million Americans’ social security numbers being leaked online. Yes, that’s right, your social security number is out there and it has been for over five years. And of course this isn’t the only incident which leaked customer data.

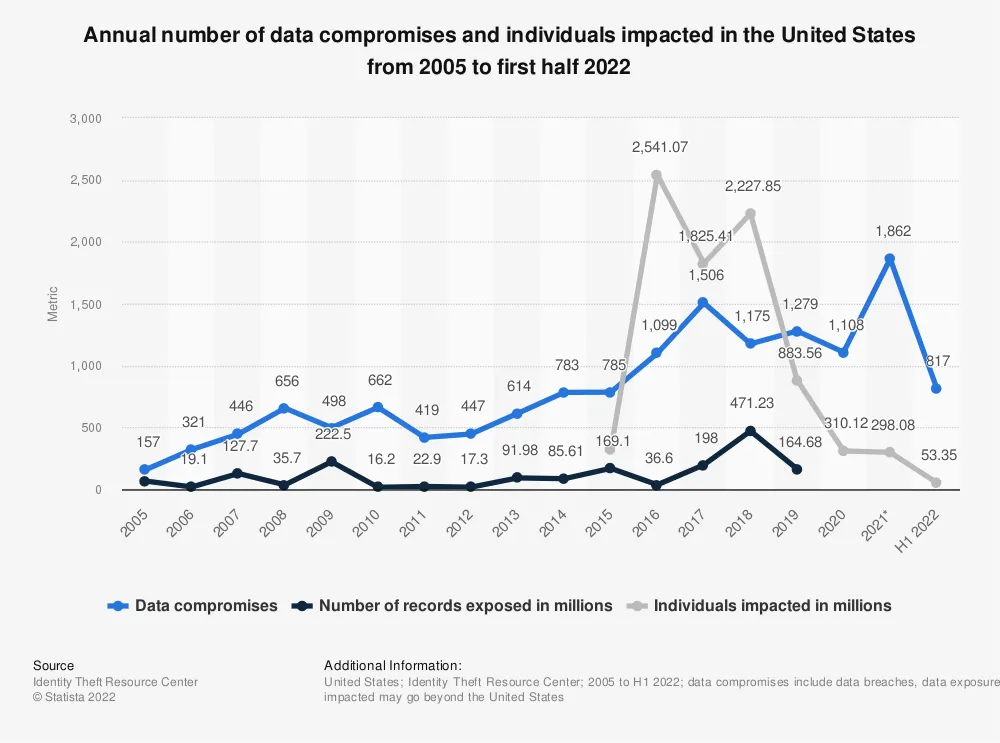

(Statista – 2022)

We don’t have to look that far back to see examples of breach events. In 2021 alone, there were 4,145 publicly disclosed data breaches. Chances are you didn’t hear about anywhere near that number of breaches. Many of these were small breaches which didn’t impact consumers or only impacted a small number of consumers.

The bottom line here is this: companies are not doing enough to keep your data secure. So what should you do about it? By now you should begin to understand that you cannot count on a company to keep your data secure. So take matters into your own hands, and take steps to prevent yourself from being impacted. Let’s outline a few simple strategies you can use to take matters into your own hands.

#1 – Take online security seriously

The best way to keep yourself secure is to take it seriously. Build security practices into your life as standard practice. There are a few ways to do this and the strategies differ based on what the goal is. So let’s outline a few methods for doing this.

The number one thing you can do is utilize good authentication practices. In a previous article I discussed how you can utilize good password practices to make it very hard to break into your online accounts.

Assume that all your data can be stolen at any moment from every company you’ve ever used. So, take steps to limit the amount of your data they have. If you don’t use an account anymore, find out how to delete it. Contact organizations you no longer do business with, and ask them to remove your data.

Use a security mindset when opening and reading email. If you have an email that looks like it might be spam, don’t even open it, just mark it as spam. If a friend sends you an email or text asking for information they wouldn’t normally ask for, don’t provide it. Contact them and make sure their account hasn’t been compromised.

If anyone asks you for your password or other type of login information, don’t provide it. Technical and customer service teams will never ask you for login information. So if someone is asking for login information, chances are very good it is not legitimate.

#2 – Simple steps to prevent financial fraud

There are a few things you can do to help prevent fraud and identity theft from ever occurring to you. Admittedly, these steps do add a little bit of inconvenience to your life. But would you rather have a little inconvenience or your life turned upside down by identity theft?

First, understand how credit works. There are four credit bureaus – Equifax, Experian, Trans Union and Innovis. Start a security freeze on all four of them. This article by Krebs on Security is an excellent resource to help with the steps of security freezes. A security freeze prevents new credit accounts from being opened, eliminating the possibility of identity theft.

Monitor your credit cards and bank accounts regularly, at least weekly. If any fraudulent charges show up, immediately notify your bank or credit card company and request a new card.

Also, stick with companies that are easy to work with when it comes to fraudulent reporting. I once had a fraudulent charge from North Korea show up on an account. The company was awful, it took me weeks to get that charge and the international fee removed from the account. As soon as those charges were off my account I closed that card.

Finally, you can take an extra step to prevent fraud charges from ever showing up on your account. Assume your cards are being compromised regularly. Every 6-12 months, request a new card from your bank or credit card company. Once you have the new card, ensure the old one is deactivated. This way, if your old card is stolen in a breach you have nothing to worry about.

#3 – Stay vigilant offline as well

Ok so the steps above should prevent the vast majority of identity theft and fraud. But what about those other steps mentioned commonly by other articles online? Yeah, those steps are still important as well.

Get yourself a good quality shredder with cross-cut and shred every financial document. Even those pre-approval notices, shred those also. This prevents anyone from being able to use your mail or any other physical documents to steal information. Decent shredders range from $50-150, don’t just buy the cheapest one, do a little research and get a quality one.

Better yet, use the permanent Opt-Out process to remove yourself from those pre-approved notices. It’s a simple process that involves filling out an online form, and then printing and mailing a short document. Learn more at www.optoutprescreen.com.

Stay vigilant over the phone as well. If someone calls you and asks for payment information, be sure they are who they claim to be. There are countless scams out there claiming to be everything from the phone company to the FBI. If the FBI was going to fine you, they wouldn’t be doing it over the phone. Make sure you know the person asking for money. If in doubt, use a previous statement or the companies website to find their customer support number and call them to pay instead of relying on this stranger that called you.

Last, if you lose your wallet or any other financial information, act as if it’s been taken by a fraudster. Deactivate everything and get all new cards. Hopefully your wallet is found by a good Samaritan and returned, but don’t count on that strategy.

Conclusion

Ok there you have it, a few simple strategies you can implement to help prevent identity theft and fraud. There are always new things going on in the world that may require new strategies in the future. If you want to stay up to date on the latest strategies you can use to stay safe online, follow us on social media or sign up for our newsletter.

References